New multi-asset funds are joining the Asian Islamic funds sector, and new sukuk funds seek to capture investor demand for sharia-compliant fixed income. Blake Goud of the Zawya Islamic and Islamic Finance Gateway at Thomson Reuters discusses the trends.

New multi-asset funds are joining the Asian Islamic funds sector, and new sukuk funds seek to capture investor demand for sharia-compliant fixed income. Blake Goud of the Zawya Islamic and Islamic Finance Gateway at Thomson Reuters discusses the trends.

Last year’s launch activity follows several years of inflows into emerging markets that were driven by central bank policy.

Decreased returns on lower-risk assets in the developed markets had led to significant flows into and gains in emerging market equity and debt sectors.

There was a focus on Asian emerging market-focused funds, despite a reversal of this trend last year when emerging markets – including the two largest countries as measured by new fund activity, Indonesia and Malaysia – experienced a flat year.

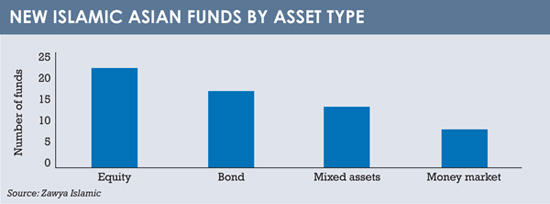

Even though developed market equity indices made further gains last year, fund managers continued to launch new equity and sukuk funds in emerging Asian markets.

The geographical focus of most of the new funds was within the Southeast Asian region, mainly Indonesia and Malaysia.

The universe of new Asian Islamic funds is dominated by domestically focused funds – which are those domiciled in the countries in which their geographical focus lies and aimed at domestic investors.

The few alternatives domiciled in Luxembourg are focused more broadly on the developing Asian economies, rather than on a single country.

The new equity funds are likely to be focused on investors attracted to strong growth prospects and high recent equity market performance.

Whereas the growth in sukuk funds could be driven more by the continued gap between Islamic fixed income product supply and demand.

Globally, this gap grew further throughout last year and is expected to peak at $230 billion this year, before declining to $187 billion by 2018, according to a Thomson Reuters Zawya sukuk perceptions and forecast study conducted this year.

The new fund growth was driven in large part by new equity and sukuk funds, however, the largest fund inflows were concentrated primarily in equity funds and Asian funds feature prominently on the worldwide top ten list of fund inflows.

The new fund growth was driven in large part by new equity and sukuk funds, however, the largest fund inflows were concentrated primarily in equity funds and Asian funds feature prominently on the worldwide top ten list of fund inflows.

Despite the growth in Asian sukuk funds throughout last year, the largest Asian fund outflow was from a sukuk fund, followed by two money market funds, which each lost more than half the funds’ assets under management.

Notable within the global Islamic fund industry is that the magnitude of the inflows to Asian Islamic funds was larger than the outflows. There were also fewer Asian Islamic funds focused on the commodity and commodity producer sector, where the outflows were the greatest.

To get a fuller picture on the Asian Islamic fund sector, it is helpful to take a look at the largest funds in the region. Malaysian equity funds dominate the Asian Islamic fund sector, holding seven of the top ten spots in total assets under management.

This is a reflection of the early stage at which the Islamic fund management is at today: no fixed income funds made the list of the largest funds, not even those in Malaysia, which has the most developed sukuk market.

The changes seen last year reflect continued development in the Asian Islamic fund sector as new multi-asset funds are joining the picture and more sukuk funds are entering to capture investor demand for sharia-compliant fixed income, which are likely to continue into the future as the sukuk markets develop in Malaysia, within Asia and

also globally.

Blake Goud is a community leader of Zawya Islamic and the Islamic Finance Gateway at Thomson Reuters

©2014 funds global asia

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets. A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services. The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade. Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda. Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust. Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.