The share of long/short equity hedge funds in Asia has fallen as the market matures and investors increasingly seek strategies that are less correlated to underlying markets. Stefanie Eschenbacher looks at the numbers.

Equity long/short is loosing its appeal in Asia.

While the majority of Asian hedge funds still trade relatively plain vanilla positions, the market share of long/short equity funds has fallen from more than half to just over a third since 2007.

Farhan Mumtaz, head of analysis and research at Singapore-based data provider Eurekahedge, says much of this decline happened during the financial crisis.

Both managers and investors increasingly seek strategies that are less correlated to underlying markets.

Both managers and investors increasingly seek strategies that are less correlated to underlying markets.

Equity long/short managers suffered heavier losses than other managers, but Mumtaz says their decline is characteristic of a growing and maturing market.

Event-driven strategies saw their market share almost triple, while multi-strategies and fixed income strategies have gained traction, too.

“Event-driven strategies have found cheap assets and picked up opportunities,” he says. “Fixed income plays are also becoming increasingly popular in Asia.”

GEOGRAPHICS

While there is a desire to move away from traditional long/short equity, Mumtaz says it is still challenging to run certain strategies in Asia because the derivatives they need are not available.

“The most successful strategies in general have been those employed by commodity trading advisors (CTA), but few of them are focused on Asia.”

The breakdown of geographic mandates has changed significantly, too. Most notably, the share of managers with a global mandate has nearly doubled.

Mumtaz says adopting a global mandate has helped fund managers diversify their risk and also access a wider selection of securities.

Mumtaz says adopting a global mandate has helped fund managers diversify their risk and also access a wider selection of securities.

Globally mandated Asian hedge funds, he adds, did not suffer losses to the same extend as hedge funds focused specifically on Asia or single countries within the region.

Interest in the Greater China region has increased, where Mumtaz says managers seek out opportunities in what seems to be a vibrant and growing economy.

Hedge funds investing in Asia, including Japan, have lost the largest share, though.

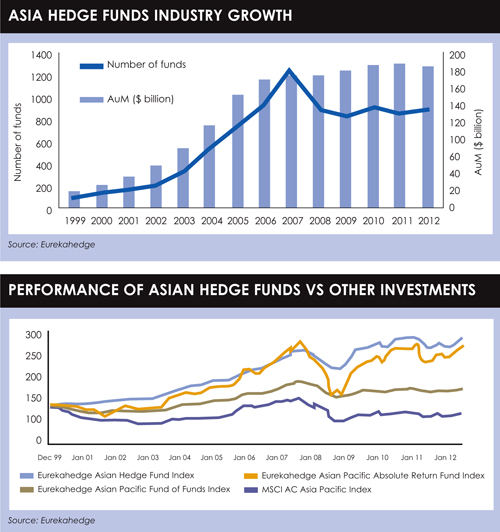

Growth in the post-financial crisis years has been slow, at least compared with growth rates the industry has seen in the past.

FAILURES

In the boom years leading up to the financial crisis, the number of hedge funds in Asia had increased six-fold and total assets under management had grown by 900%.

Hedge fund assets under management are now at $1.83 trillion, almost the all-time-high of $1.9 trillion in April 2008.

A few large hedge funds are increasingly attracting assets at the expense of smaller ones. The industry in Asia is growing, even though hedge funds have always had a high failure rate.

Calculated from the data provided, Mumtaz says half of Asian hedge funds closed within the first three years. This compares with a 25% average for all Asian funds.

Exactly how many fail is hard to tell because hedge funds are self-reporting. It has often been estimated that the real failure rate is more between 60% and 80%.

Mumtaz says raising assets has become harder in general, and anecdotal evidence suggests that some funds, which previously insisted on a minimum investment of $1 million, now take in as little as $200,000.

“Investors used to attend three to five meetings and then wrote a cheque,” he says, adding that now meetings are usually set up only after a year or so of internal research and due diligence.

©2013 funds global asia

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets. A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services. The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade. Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda. Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust. Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.