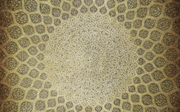

Conventional, Islamic and investors who apply environmental, social and governance factors should focus on what unites them. Murat Ãnal of Funds@Work explains how a more sustainable finance system can be built.

Conventional, Islamic and investors who apply environmental, social and governance factors should focus on what unites them. Murat Ãnal of Funds@Work explains how a more sustainable finance system can be built.

Conventional, Islamic and investors who apply environmental, social and governance factors should focus on what unites them. Murat Ãnal of Funds@Work explains how a more sustainable finance system can be built.

Conventional, Islamic and investors who apply environmental, social and governance factors should focus on what unites them. Murat Ãnal of Funds@Work explains how a more sustainable finance system can be built.

Indonesia was the worst-hit country during the Asian financial crisis and summer stirred up bad memories. Stefanie Eschenbacher finds asset managers in Jakarta are focusing on the long-term potential.

Indonesia was the worst-hit country during the Asian financial crisis and summer stirred up bad memories. Stefanie Eschenbacher finds asset managers in Jakarta are focusing on the long-term potential.

Michael T. Tjoajadi of Schroder Investment Management Indonesia tells Stefanie Eschenbacher that local asset management skills need to be strengthened, ahead of the country joining a regional fund passport scheme developed by Singapore, Malaysia and Thailan.

Michael T. Tjoajadi of Schroder Investment Management Indonesia tells Stefanie Eschenbacher that local asset management skills need to be strengthened, ahead of the country joining a regional fund passport scheme developed by Singapore, Malaysia and Thailan.

Michael T. Tjoajadi of Schroder Investment Management Indonesia tells Stefanie Eschenbacher that local asset management skills need to be strengthened, ahead of the country joining a regional fund passport scheme developed by Singapore, Malaysia and Thailan.

Michael T. Tjoajadi of Schroder Investment Management Indonesia tells Stefanie Eschenbacher that local asset management skills need to be strengthened, ahead of the country joining a regional fund passport scheme developed by Singapore, Malaysia and Thailan.

Indonesia will have to reinvent the concept of Islamic finance to compete with its rival Malaysia, whose assets dwarf those of all other Asian countries combined. Stefanie Eschenbacher talks to the central bank and other pioneers.

Indonesia will have to reinvent the concept of Islamic finance to compete with its rival Malaysia, whose assets dwarf those of all other Asian countries combined. Stefanie Eschenbacher talks to the central bank and other pioneers.

In an industry that is essentially based on ethics, sharia scholars make powerful decisions. Stefanie Eschenbacher talks to sheikh Yusuf Talal DeLorenzo about his work as a sharia scholar and the future of Islamic finance.

In an industry that is essentially based on ethics, sharia scholars make powerful decisions. Stefanie Eschenbacher talks to sheikh Yusuf Talal DeLorenzo about his work as a sharia scholar and the future of Islamic finance.

In an industry that is essentially based on ethics, sharia scholars make powerful decisions. Stefanie Eschenbacher talks to sheikh Yusuf Talal DeLorenzo about his work as a sharia scholar and the future of Islamic finance and the future of Islamic Finance.

In an industry that is essentially based on ethics, sharia scholars make powerful decisions. Stefanie Eschenbacher talks to sheikh Yusuf Talal DeLorenzo about his work as a sharia scholar and the future of Islamic finance and the future of Islamic Finance.

This year saw 68 newly launched sharia-compliant Asian funds, with the most of the funds launched focusing on the Indonesian market. Zawya Islamic â Lipper analyses the data.

This year saw 68 newly launched sharia-compliant Asian funds, with the most of the funds launched focusing on the Indonesian market. Zawya Islamic â Lipper analyses the data.

Assets of sharia-compliant funds and conventional funds are still commingled in Indonesia, but custodians say that as Islamic finance grows they might be asked by the regulator to separate the two. Stefanie Eschenbacher looks at the custody business.

Assets of sharia-compliant funds and conventional funds are still commingled in Indonesia, but custodians say that as Islamic finance grows they might be asked by the regulator to separate the two. Stefanie Eschenbacher looks at the custody business.

The gold price is expected to decline by 20% this year, likely to make the first annual loss in 13 years. Muriel Oatham finds that as American and European investors leave the market, the appetite for gold in Asia shows no signs of abating.

The gold price is expected to decline by 20% this year, likely to make the first annual loss in 13 years. Muriel Oatham finds that as American and European investors leave the market, the appetite for gold in Asia shows no signs of abating.

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets.

The spotlight on growth markets and the need to be nimble and dynamic is ever-sharper, given the difficulty in predicting monetary policy in the world’s major nations.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

David Hunt, president and chief executive of PGIM, tells Romil Patel about leading a top 10 global asset manager in times where “empowering and encouraging the kind of investment decisions as...

Nicolas Moreau, CEO of HSBC Asset Management, is moving to Asia as the firm looks to connect more directly with the region’s growth story. ESG is also a key focus – including the ‘just’ carbon...

Funds Europe, the sister publication of Funds Global Asia, hosted an India investment discussion with two seasoned experts and asked if India is the ‘last one standing’ from the Brics phenomenon. We also hear that for India, the inclusion of Indian bonds in a major index may not be the desired...

Strong ESG credentials strengthen the case for Singapore as a leader in Asia of the post-Covid recovery. Our panel discusses the risks and opportunities.