Edward Glyn, Head of Global Markets, Calastone, analyses the state of automation in fund administration across the world.

Now managing $103 trillion in assets1, the global funds industry plays the integral role in looking after the savings of ordinary retail investors alongside institutions such as pension schemes, sovereign wealth funds and insurance companies. But how well does our industry serve investors across the world?

The global asset management ecosystem is incredibly diverse, with different and often conflicting regulations, varying distribution channels and levels of maturity across markets. The ecosystem is also still highly fragmented in some areas, with reliance on systems and technology that are often outdated, with manual processes prevalent.

While efforts to stimulate better automation in activities such as fund distribution are increasing globally, fund admin in particular continues to lag behind. Fund administrators are crucial cogs in the asset management machine, supporting investment firms with their NAV [net asset value] calculations; investor and regulatory reporting; transfer agency and distribution services. These are essential services in enabling the industry to provide investors with an efficient and effective investment experience. Given the importance of the role this part of our industry plays, we surveyed fund administrators in five major markets to understand levels of automation globally and identify what the key challenges are.

Tackling regional divides on automation

Edward Glyn, Head of Global Markets, Calastone, analyses the state of automation in fund administration across the world.

Now managing $103 trillion in assets1, the global funds industry plays the integral role in looking after the savings of ordinary retail investors alongside institutions such as pension schemes, sovereign wealth funds and insurance companies. But how well does our industry serve investors across the world?

The global asset management ecosystem is incredibly diverse, with different and often conflicting regulations, varying distribution channels and levels of maturity across markets. The ecosystem is also still highly fragmented in some areas, with reliance on systems and technology that are often outdated, with manual processes prevalent.

While efforts to stimulate better automation in activities such as fund distribution are increasing globally, fund admin in particular continues to lag behind. Fund administrators are crucial cogs in the asset management machine, supporting investment firms with their NAV [net asset value] calculations; investor and regulatory reporting; transfer agency and distribution services. These are essential services in enabling the industry to provide investors with an efficient and effective investment experience. Given the importance of the role this part of our industry plays, we surveyed fund administrators in five major markets to understand levels of automation globally and identify what the key challenges are.

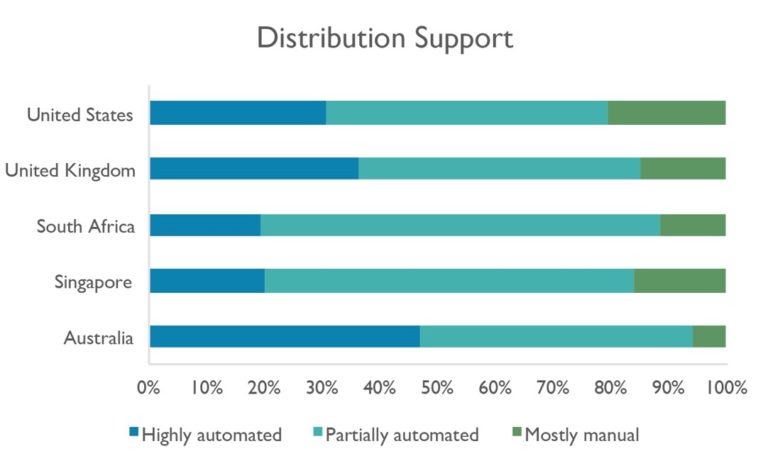

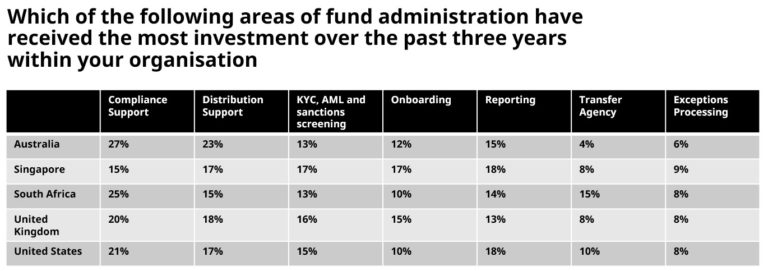

Tackling regional divides on automationDespite digital transformation now becoming a top priority for asset managers globally2, our survey found that automation in fund admin appears to be lagging in all major markets surveyed. In particular, a large proportion of service providers in the US, the UK, South Africa, Australia and Singapore conceded that certain activities – namely compliance support; distribution support; KYC, AML and sanctions screening; client onboarding; and reporting – are still either mostly manual or only partially automated. Levels of automation, however, vary significantly across markets. Take distribution support, which is reasonably well automated in Australia, but much less so in Singapore, South Africa, the US and the UK.

The sheer diversity of global distribution models could be a key factor in explaining the uneven levels of automation at asset servicers around the world. For example, whereas fund distribution networks in the UK are primarily dominated by IFAs [independent financial advisers] and platforms, banks are responsible for the majority of fund sales in Singapore.

Market maturity is also a key factor in explaining the different levels of automation. The UK and US market are far larger and more advanced fund markets than those in South Africa or parts of Asia. The cost of labour is also much higher, resulting in a more robust approach to automation and cost reduction.

In the Australian market, commercial banks, who make up a large proportion of respondents, outsource much of their manual processes to third parties, which could help to explain their perceived higher levels of automation.

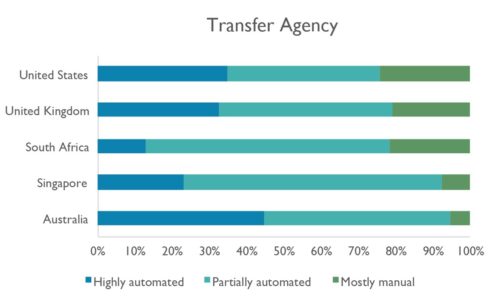

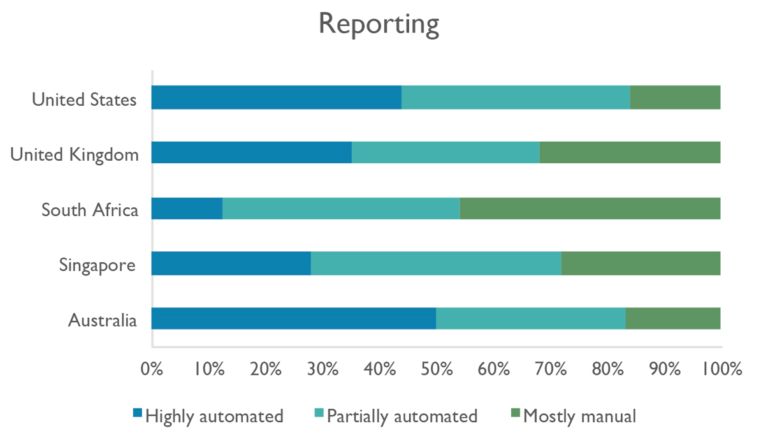

A similar trend to distribution can be seen in the levels of automation of transfer agency (TA) and reporting, with less mature markets lagging behind the developed ones, although mostly manual processes are more commonly used in the US and UK for TA functions.

The sheer diversity of global distribution models could be a key factor in explaining the uneven levels of automation at asset servicers around the world. For example, whereas fund distribution networks in the UK are primarily dominated by IFAs [independent financial advisers] and platforms, banks are responsible for the majority of fund sales in Singapore.

Market maturity is also a key factor in explaining the different levels of automation. The UK and US market are far larger and more advanced fund markets than those in South Africa or parts of Asia. The cost of labour is also much higher, resulting in a more robust approach to automation and cost reduction.

In the Australian market, commercial banks, who make up a large proportion of respondents, outsource much of their manual processes to third parties, which could help to explain their perceived higher levels of automation.

A similar trend to distribution can be seen in the levels of automation of transfer agency (TA) and reporting, with less mature markets lagging behind the developed ones, although mostly manual processes are more commonly used in the US and UK for TA functions.

There is clearly still a huge amount of work required to digitalise and automate fund administration activities, regardless of location. But is the will there to automate, and where might the world of fund admin be heading?

Maximising the potential of fund administration and transfer agency

There is clearly still a huge amount of work required to digitalise and automate fund administration activities, regardless of location. But is the will there to automate, and where might the world of fund admin be heading?

Maximising the potential of fund administration and transfer agencyMany banks and asset managers – especially in tough macro environments – have not historically taken products like fund servicing as seriously as they should, viewing them as being low margin, resource intensive and high cost. In many instances, these negative perceptions have translated into less focus that is needed on fund administration services, at least relative to certain front office or client-facing activities. Take transfer agency for example. Our survey found just 4% of Australian providers [rising to 8% in the UK and Singapore] said TA accounted for the majority of the investment they made in their fund administration businesses. But TA is one of the most challenged areas of fund admin in terms of cost and inefficiency. We saw this during the pandemic, where many TA systems were found wanting and these deficiencies did not go unnoticed at asset managers. A number of fund houses that I have spoken to said that they were unimpressed by the service quality they received from their TAs during the height of the pandemic, particularly around real time reporting and cash positions. As we’ve seen from the survey results TA is still far from fully automated and by failing to automate, providers risk losing their market share or being disintermediated altogether.

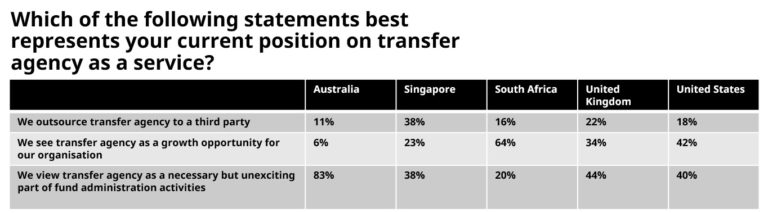

A well automated transfer agency in fact could bring significant opportunity for the industry. There are mixed views on this according to our survey, however. While market participants in Australia feel that TA does not present much opportunity at all [just 6% of providers saw the business as an opportunity], other countries are more bullish about its prospects, with 64% of providers in South Africa saying TA offered significant potential. I think this demonstrates forward-thinking.

A well automated transfer agency in fact could bring significant opportunity for the industry. There are mixed views on this according to our survey, however. While market participants in Australia feel that TA does not present much opportunity at all [just 6% of providers saw the business as an opportunity], other countries are more bullish about its prospects, with 64% of providers in South Africa saying TA offered significant potential. I think this demonstrates forward-thinking.

So where could this potential be found? There is significant opportunity for growth for TA and it will come not just from ironing out issues that exist today through automation and cost reduction, but about using the skills and market placement that TAs have and using it to support completely new ways of investing.

Meeting the needs of new asset types

So where could this potential be found? There is significant opportunity for growth for TA and it will come not just from ironing out issues that exist today through automation and cost reduction, but about using the skills and market placement that TAs have and using it to support completely new ways of investing.

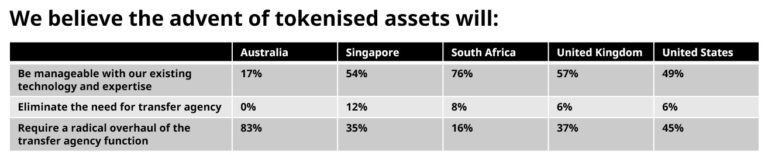

Meeting the needs of new asset typesA key area we explored in our survey was tokenised assets, which has started to enter mainstream thinking for many asset managers. These types of investments could be an excellent opportunity for fund administrators. According to a recent study by Fidelity Digital Assets, 52% of respondents said they were exposed to digital assets, while 70% of all investors told the survey they had a neutral to positive perception about digital assets. The emergence of digital or tokenised assets could have a transformative impact on the functioning of both capital markets and the wider funds ecosystem. Despite this, a large proportion of fund administrators globally [with the exception of Australia] opined in our survey that these changes can be managed using transfer agency’s existing technology and expertise. I feel, however, that for TA to support new ways of investing such as tokenisation, a fully digital infrastructure would be needed that could enable the real-time flow of information. We recently covered this topic extensively in our white paper‘The Future of Fund Administration’, where we discuss the infrastructure changes that would be required to support tokenisation. If asset servicers successfully prepare for this incoming digital revolution, then they will be able to seamlessly support fund manager clients in launching tokenised products and other new financial instruments. Through automation, reduced costs and a new way of manage TA functions, fund administrators could play an integral role in driving the digital asset revolution, safeguarding their role in the investment ecosystem of tomorrow.

Automation is key to survival

Automation is key to survivalOur research has illustrated that while fund administrators face some significant challenges for their future, there are excellent opportunities available which could help them reinvent their businesses. If global fund administrators are to remain relevant, most will need to make some swift changes to their business models. While we have seen that some markets are at a more advanced stage than others in terms of their automation levels, it is crucial that those which have fallen behind embrace digitalisation so they can compete in the future. Whether that be through an advancement of the way investing operates today, or entirely new ways of investing such as tokenised assets. 1 – Boston Consulting Group data

2 – Navigating Through the Storm, Deloitte, February 2021

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets. A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services. The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade. Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda. Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust. Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.