There are signs that China’s debt stress is moving it towards a Japanese-style stagnation, writes Lale Akoner, market strategist at BNY Mellon Investment Management.

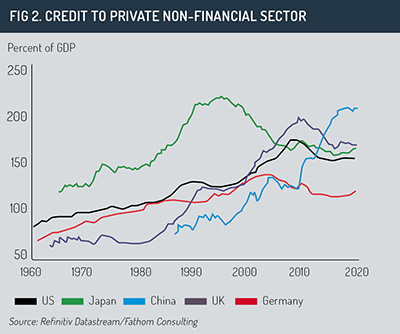

China is walking a tightrope. On the one hand, it targets stable economic growth while maintaining its ambitious long-term goal of transforming itself from an investment to a consumption-led economy. On the other hand, it aims to deflate its mountainous post-global financial crisis debt build-up in the hopes of avoiding the fate of historical examples of countries with similar trajectories of credit growth, for example a debt crisis coupled with a deep economic contraction.

The deleveraging mandate has been fruitful, but the data suggests that Chinese debt levels remain elevated.

On the other hand, financial markets remain sanguine that a hard landing, such as a financial crisis, may not ensue. This complacency in markets may be due to the widely held belief that credit booms always lead to one single disruptive event, i.e. a debt crisis (odds are about one out of four that once a country enters a credit boom, it will end with a currency or a banking crisis1).

However, the current macroeconomic policies may be insufficient to prevent a longer-term growth slowdown beyond 2025, and the debt stress China currently faces may move the country towards a Japanese-style stagnation.

There are signs that China’s debt stress is moving it towards a Japanese-style stagnation, writes Lale Akoner, market strategist at BNY Mellon Investment Management.

China is walking a tightrope. On the one hand, it targets stable economic growth while maintaining its ambitious long-term goal of transforming itself from an investment to a consumption-led economy. On the other hand, it aims to deflate its mountainous post-global financial crisis debt build-up in the hopes of avoiding the fate of historical examples of countries with similar trajectories of credit growth, for example a debt crisis coupled with a deep economic contraction.

The deleveraging mandate has been fruitful, but the data suggests that Chinese debt levels remain elevated.

On the other hand, financial markets remain sanguine that a hard landing, such as a financial crisis, may not ensue. This complacency in markets may be due to the widely held belief that credit booms always lead to one single disruptive event, i.e. a debt crisis (odds are about one out of four that once a country enters a credit boom, it will end with a currency or a banking crisis1).

However, the current macroeconomic policies may be insufficient to prevent a longer-term growth slowdown beyond 2025, and the debt stress China currently faces may move the country towards a Japanese-style stagnation.

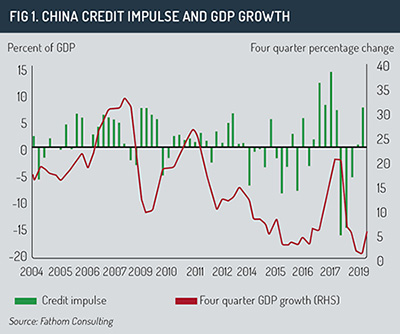

At low debt-to-GDP ratios, the welfare of a country improves as credit finances low-hanging-fruit projects such as basic infrastructure, generating growth. But, beyond a certain level of debt (at approximately 150%-200% debt-to-GDP ratio) credit provides less of a boost to growth. Countries start to get increasingly less bang for their buck and for each additional yuan of credit, getting less output (fig 1).

Credit starts to finance unproductive assets, companies, and less profitable projects with little or no return. According to some measures, Chinese non-performing loans (NPLs) amounted to between 28% and 38% in 2018 – up from 5% a decade earlier, as the number of new NPLs outpaced the disposal of old NPLs2. That is where China is now.

Even though China’s debt problem is largely a domestic issue, the government’s tight control of the debt (corporates have been lent to by the banks and shadow banks, which are implicitly underwritten by the government) may mean that a hard landing scenario is not imminent in the near future. But this is precisely why the debt overhang may precede a stagnation as credit efficiency deteriorates further and macro policy framework becomes ineffective in reviving the Chinese economy.

At low debt-to-GDP ratios, the welfare of a country improves as credit finances low-hanging-fruit projects such as basic infrastructure, generating growth. But, beyond a certain level of debt (at approximately 150%-200% debt-to-GDP ratio) credit provides less of a boost to growth. Countries start to get increasingly less bang for their buck and for each additional yuan of credit, getting less output (fig 1).

Credit starts to finance unproductive assets, companies, and less profitable projects with little or no return. According to some measures, Chinese non-performing loans (NPLs) amounted to between 28% and 38% in 2018 – up from 5% a decade earlier, as the number of new NPLs outpaced the disposal of old NPLs2. That is where China is now.

Even though China’s debt problem is largely a domestic issue, the government’s tight control of the debt (corporates have been lent to by the banks and shadow banks, which are implicitly underwritten by the government) may mean that a hard landing scenario is not imminent in the near future. But this is precisely why the debt overhang may precede a stagnation as credit efficiency deteriorates further and macro policy framework becomes ineffective in reviving the Chinese economy.

In the late 1990s and 2000s, China had similar debt build-up issues, when the severe accumulation of non-performing loans of big banks were dealt with via bad asset disposals and strong economic growth, as well as financial repression in the form of negative real deposit rates – essentially subsidy from depositors to borrowers and banks.

This time around, the debt issue is harder to resolve given external and domestic forces that challenge the economic growth, such as coronavirus and the US-China trade war, as well as the commitment to transform the economy into a consumption-led one rather than an investment-driven one.

1 – Source: Mendoza, E, Terrones, M. “An Anatomy of Credit Booms and Their Demise”, NBER, 2012

In the late 1990s and 2000s, China had similar debt build-up issues, when the severe accumulation of non-performing loans of big banks were dealt with via bad asset disposals and strong economic growth, as well as financial repression in the form of negative real deposit rates – essentially subsidy from depositors to borrowers and banks.

This time around, the debt issue is harder to resolve given external and domestic forces that challenge the economic growth, such as coronavirus and the US-China trade war, as well as the commitment to transform the economy into a consumption-led one rather than an investment-driven one.

1 – Source: Mendoza, E, Terrones, M. “An Anatomy of Credit Booms and Their Demise”, NBER, 20122 – Source: Fathom Consulting © 2020 funds global asia

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets. A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services. The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade. Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda. Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust. Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.