The Morningstar Hong Kong Fund Awards are designed to help investors around the world identify the yearâs most exceptional funds and fund managers in Hong Kong, honouring those that have added the most value for investors.

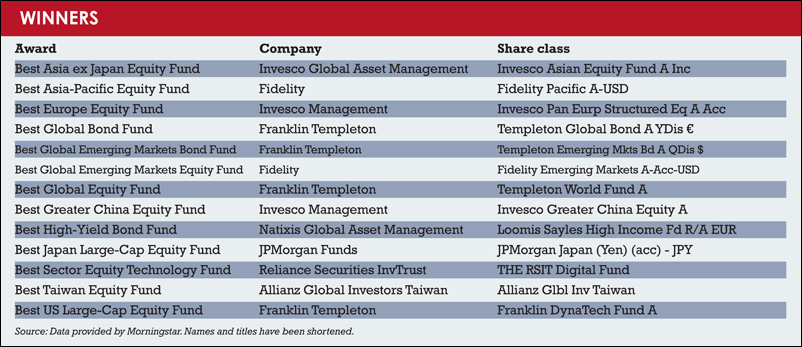

HONG KONG

The two fund house awards in Hong Kong, Best Equity Fund House and Best Fixed Interest Fund House, acknowledge the fund houses with the strongest risk-adjusted performance across their fund line-ups.

This year, the awards went to First State and BlackRock.

“We are pleased to have a mix of high-quality asset managers winning awards across our equity and fixed income categories,” says Wing Chan, Morningstar Asia’s director of fund research.

“Our fund house winners this year, First State and Pimco, are established investment managers that are well regarded by investors globally.”

Chan says both fund providers have delivered outstanding risk-adjusted returns across their range of funds.

SINGAPORE

The Morningstar Singapore Fund Awards recognise retail funds and fund houses that added the most value for investors within the context of their relevant peer group in 2013 and over the longer term. Return calculations are adjusted for risk; there is a higher penalty for downside variation.

The fund house award, best equity fund house, acknowledges the fund group with the strongest risk-adjusted performance across its fund line-up.

As is the case in other countries, winners are selected using a quantitative methodology with a qualitative overlay, developed by Morningstar, that considers the one-, three-, and five-year performance history of eligible funds. Morningstar adjusts the returns for risk by applying its risk filter.

This is a measure that imposes a higher penalty for downside variation in a fund’s return than it does for upside volatility.

Wing Chan, Morningstar Asia’s director of fund research, says its range of equity funds has a high relevance to investors based in Singapore.

CHINA

The selection range of Morningstar China Annual Fund Awards is confined to Chinese domestic mutual funds and hedge funds, which have at least a one-year return. With the increased appeal of hedge funds, Morningstar China has added a new awards category that focuses on hedge funds.

The range of funds rated by Morningstar China includes open-end funds and closed-end funds that are set up with the approval of the China Securities and Regulatory Commission.

Over the last decade, hedge funds have proliferated in China and become an accepted investment vehicle for institutional investors and high net-worth individuals in the country.

Morningstar China has, therefore, added one hedge fund category that recognises this: Best China Long/Short Equity Fund.

With the Morningstar Fund Awards being held annually, the emphasis is usually on a fund’s one-year performance.

However, Morningstar Asia does not wish to be in a position of giving awards to funds that have posted a strong one-year return, but have otherwise not delivered good results for investors. The concern is that investors will often use awards as a “buy” signal, and Morningstar does not wish to steer them to offerings that may not be good longer-term investments. Funds must, therefore, also have delivered strong three-year returns, after adjusting for risk within the awards peer groups in order to obtain an award.

This philosophy applies for all awards, hedge funds or not.

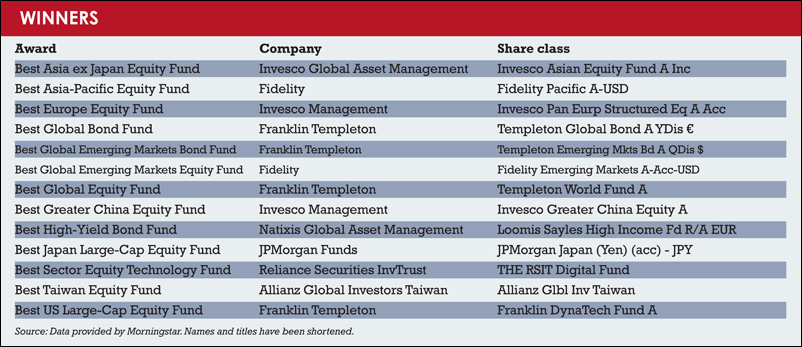

TAIWAN

Morningstar Asia presents 13 category awards in Taiwan, aiming to identify the most value-adding mutual fund in each category. The Morningstar Taiwan Fund Awards are highly regarded by the local investor community and the fund industry.

Taiwan is one of the major host economies of funds in Asia.

In response to the great interest in technology equity from local investors, the Morningstar Taiwan Fund Awards feature the only technology equity category award in the region.

Morningstar also promotes the idea of long-term investment and the concept of asset allocation.

The awards methodology emphasises the one-year period, but funds must also have delivered strong three- and five-year returns, and been at least in the top half of their peer groups in at least three of the past five years.

KOREA

KOREA

There are a variety of categories varying country by country, such as Korea Aggressive Allocation and Korea Cautious Allocation in Korea. The Morningstar Korea Fund Awards look at the country’s specific offerings, but the methodology applied is the same.

There are two types of Morningstar Fund Award: there is the Morningstar Category Awards and the Morningstar Fund House Awards.

Morningstar Category Awards are awards given to the funds with the best risk-adjusted performance within their Morningstar Categories or groupings of Morningstar categories, subject to a

qualitative review.

Morningstar Fund House Awards are given to the fund groups with the strongest performing fund line-ups on a risk-adjusted basis. Fund performance is evaluated within the Morningstar categories. The awards are determined for each individual national fund market, but the approach is the same across Asia, regardless of which country is concerned.

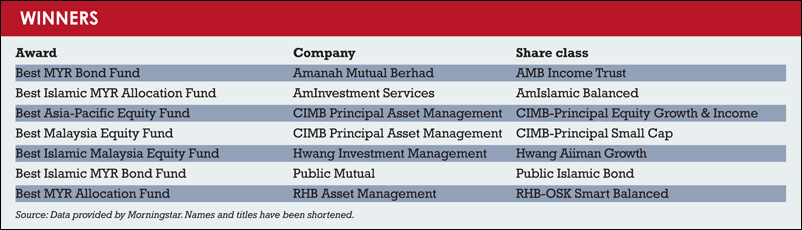

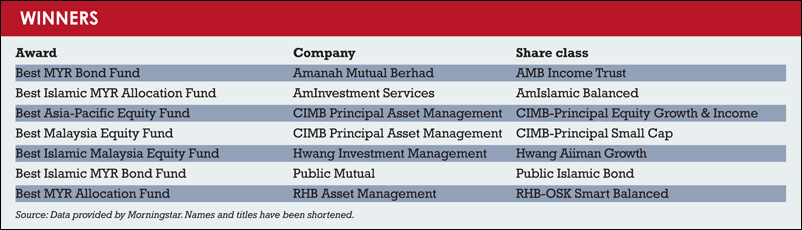

MALAYSIA

MALAYSIA

Malaysia is the largest market in Asia for Islamic finance, and the Morningstar Malaysia Fund Awards feature categories that take these preferences into consideration by adding specific fund categories that reward fund houses that provide Islamic funds.

In malaysia there are three fund categories that are unique: Islamic Malaysia Equity Fund, Islamic MYR Bond Fund and Islamic MYR Allocation fund.

These fund categories sit alongside the traditional investments in the equity, fixed interest and allocation categories.

Asia is a diverse market and the offerings vary significantly from country to country. Malaysia is the largest market for Islamic finance and the Morningstar Malaysia Fund Awards recognise this with fund categories that reward the providers of Islamic funds.

Morningstar expanded into Asia in 2000 and has grown its businesses into countries, such as Japan, Korea, India, China, Taiwan, Singapore, Malaysia, Thailand and Hong Kong over the recent years.

The operations in Asia not only offer timely information on mutual funds, but also insightful and independent analyses and unbiased fund ratings. They also offer sophisticated analytical tools to help both individual and professional investors make better investment decisions.

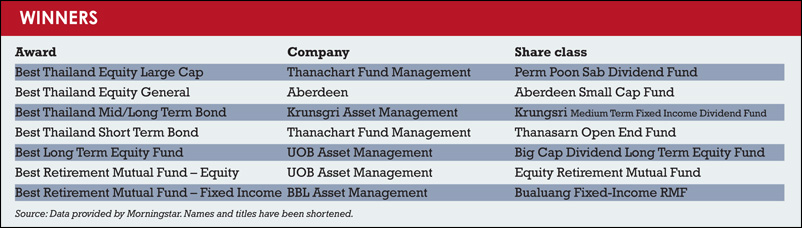

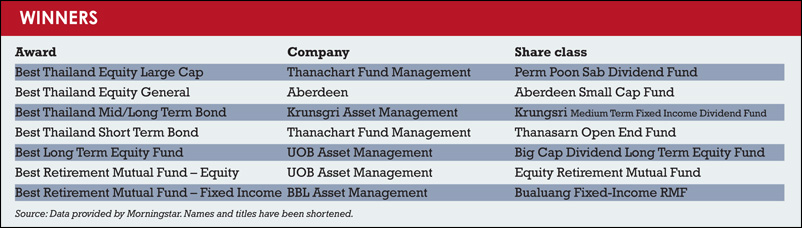

THAILAND

THAILAND

The Morningstar Thailand Fund Awards feature both local and international players.

©2014 funds flobal asia

©2014 funds flobal asia

KOREA

KOREA

MALAYSIA

MALAYSIA

THAILAND

THAILAND

©2014 funds flobal asia

©2014 funds flobal asia

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets. A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services. The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade. Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda. Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust. Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.