Investors are exposed to both the vagaries and vicissitudes of the market, and to the fund managersâ often imperfect decisions. Arne Hilke at Morningstar explains how investors can tell if fund managers are really earning their fee.

Investors are exposed to both the vagaries and vicissitudes of the market, and to the fund managersâ often imperfect decisions. Arne Hilke at Morningstar explains how investors can tell if fund managers are really earning their fee.

Fund costs are a fixed, embedded drag on returns. So it stands to reason that we ask ourselves: how can investors tell if a fund manager is earning that fee? Is he or she really adding value?

One key consideration might be to look at the alternatives. Does the fund represent reasonable value relative to other options in the market? What actively managed and index-tracking options are available?

For example, retail investors in Hong Kong seeking exposure to Chinese equities have just a handful of appropriate index-tracking open-end mutual funds and exchange-traded funds (ETFs).

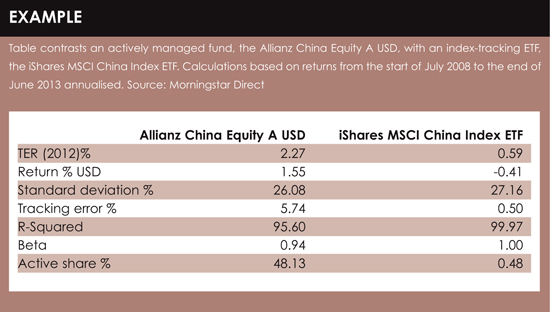

One of these index-tracking ETFs is the iShares MSCI China Index ETF, listed in Hong Kong. Its annual expense ratio is 0.59%. In contrast, the average annual cost of Chinese equity funds is 2%.

Simply put, that is a 1.41% hurdle the average active manager will have to surmount every year before offering investors value for money over and above the benchmark option.

Although investors should also consider other potential fees such as brokerage costs for ETFs and front and back-end loads for open-end funds.

Index funds should never have high fees relative to their actively managed peer funds. Of course, we also prefer lower fees for active funds. But sometimes it can be worth paying more for a strong investment proposition.

An active fund needs to be active enough to beat the benchmark consistently, or at least the most appropriate index-tracking alternatives.

To decide which active fund is right for them, investors can use a few key statistics to help them gauge how active a fund is and, therefore, what chance it has of delivering a net-of-fees return that beats its benchmark.

Tracking error is a measure of divergence of the funds' returns from a given benchmark. This is a good place to start when looking at how active a fund is. Funds that are more active will typically have a higher tracking error relative to those that are less active.

However, there are situations where tracking error will not be very meaningful, for example, when an inappropriate benchmark is used. Therefore, so should not be used in isolation.

A statistical term, R-Squared, also known as coefficient of determination, is simply a measure of best fit. If a fund has a high R-Squared relative to peers, its returns are better explained by the benchmark compared to peers.

A statistical term, R-Squared, also known as coefficient of determination, is simply a measure of best fit. If a fund has a high R-Squared relative to peers, its returns are better explained by the benchmark compared to peers.

Beta is a measure of the relative movement of fund returns compared to the benchmark. A fund that takes on more risk or exhibits greater price volatility than the market will have a beta greater than one. One that takes on less risk or exhibits less price volatility will have a beta lower than one. The closer the beta is to one, the more likely the fund is benchmark aware.

Active share measures how much a fund portfolio constituents diverge from its benchmark’s. This metric captures both the under- or overweight stock positioning, as well as any off benchmark names in the portfolio. The higher the score, relative to a maximum of 100%, the more active the portfolio.

For example, an active share score of 0.48%, such as for iShares MSCI China Index ETF (see table), means that 99.52% of the portfolio is identical to the benchmark, as one would expect for an index tracking ETF.

While these are useful statistics to get a feel for how active a fund has been, there are other points to consider.

First, if used in isolation, none of these measures give an accurate picture of whether a fund is active or not. It is entirely possible for an active fund to have a beta close to one.

Second, just because it is more active than an index fund, does not mean the higher fee is justified.

Investors should consider that there are gradations of how active a fund is. If a fund is more active than an index fund, but not much more, and its fees are relatively high, then it is harder for this fund to outperform the benchmark net of fees.

Third, it is all in the past. The returns used for these calculations are what is termed ex-post, or backward-looking, measures. If there has been a change in portfolio manager, investment strategy or market conditions, things could look very different on a forward-looking basis.

And with reward comes risk. Just as an actively managed fund can outperform its benchmark, it can also underperform.

Arne Hilke is a research analyst at Morningstar

©2013 funds global asia

At times like these, HSBC Asset Management easily pivots towards emerging markets.

At times like these, HSBC Asset Management easily pivots towards emerging markets. A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services.

A comprehensive, cost-effective, and transparent currency overlay hedging solution is crucial to mitigate FX exposure risks in the complex landscapes of Japan and China's FX markets, explains Hans Jacob Feder, PhD, global head of FX services at MUFG Investor Services. The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade.

The world is transitioning from an era of commodity abundance to one of undersupply. Ben Ross and Tyler Rosenlicht of Cohen & Steers believe this shift may result in significant returns for commodities and resource producers over the next decade. Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda.

Ross Dilkes, fixed income portfolio manager at Wellington Management, examines the opportunities and risks for bond investors presented by the region’s decarbonisation agenda. Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust.

Shareholders in Japan no longer accept below-par corporate governance standards. Changes are taking place, but there are still areas for improvement, says Tetsuro Takase at SuMi Trust. Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.

Robert St Clair, head of investment strategy at Fullerton Fund Management, explores the reasons investors should be paying attention to the rising demand for healthcare in China.